Ready to Buy Your Dream Home or Score Better Rates on Your Mortgage?

At Mercato Mortgage, we’re here to make your homeownership journey seamless and rewarding. With over $1 billion in closed home loans, we bring expertise and a personalized approach to every client.

Whether you’re a first-time buyer, upgrading to your next home, or refinancing for better rates, our dedicated team is ready to support you at every turn. We simplify the mortgage process, empowering you to make informed decisions that align with your unique goals.

Let’s turn your dream home into a reality. Get started with Mercato Mortgage today!

Why Mercato Mortgage?

Experienced Advisors

Our knowledgeable mortgage experts guide you to the best financing options.

Clear and Fair Communication

We prioritize transparency and fairness throughout your mortgage journey

Competitive Mortgage Rates

We offer some of the lowest rates in the industry, making homeownership accessible and affordable

Seamless Digital Process

Enjoy a fully paperless mortgage experience that saves you time and reduces hassle

Easy Process

01.

Get Your Custom Quote

We ask the right questions and quote accurate fees up front to get you the loan that fits your needs02.

Submit Your Application

Using our fast online application process you can refinance from start to finish from the comfort of your home03.

Verify & Document

Upload your documents in our secured portal04.

Close Your Loan

Once you're approved, we'll underwrite, appraise and close your loan in less than 21 daysLatest Mortgage Beat

Which Down Payment Strategy Is Right For You?

You've most likely heard the rule: Save for a 20-percent down payment before you buy a home. The logic

behind saving 20 percent is solid, as it shows that you have the financial discipline and stability to

save for a long-term goal. It also helps you get favorable rates from lenders.

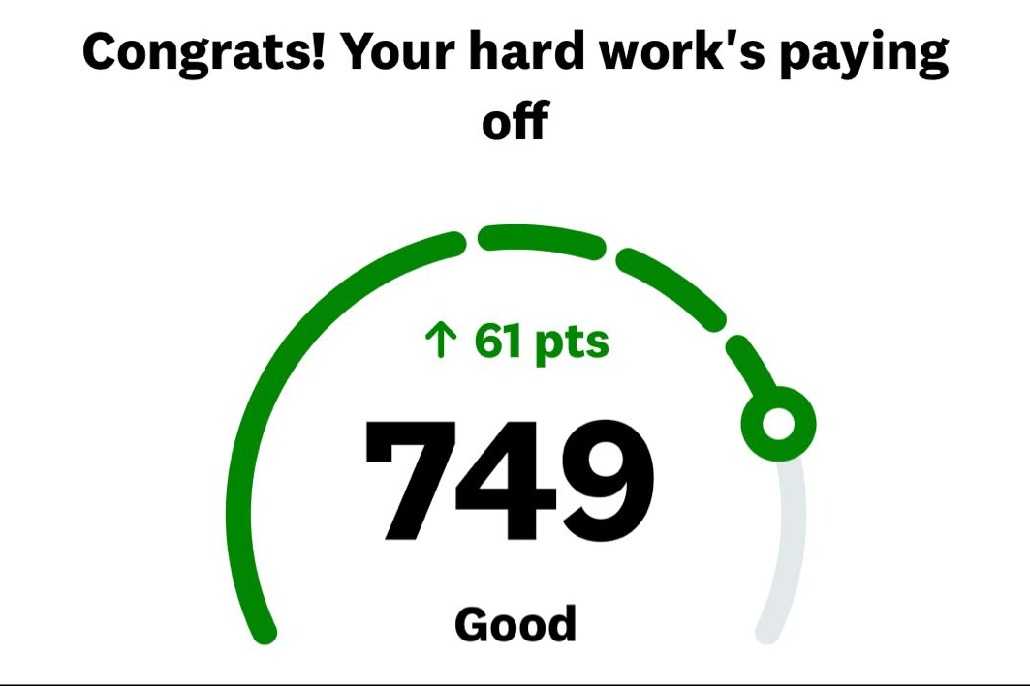

6 Tips to Boost Your Credit Score and Improve Your Financial Health

Improving your credit history is essential for gaining access to credit and loans at favorable terms. A good credit history will help you secure a mortgage, car loan, or credit card with a low-interest rate, and can even help you get approved for a job or an apartment rental.

Read More

San Jose Home Buying Mistakes: Top Pitfalls to Avoid

When it comes to buying a home in San Jose, there are a few key things to keep in mind in order to ensure that you make a smart and successful purchase. In this blog post, we'll be highlighting the top ten items that you should avoid when buying a home in San Jose.

Read More